Medical vs Dental Insurance

Medical insurance has been around since the 1920's — that's a century of evolution, refinement, and regulation. In contrast, dental insurance is a relative newcomer. Although dental insurance plans were "born" from medical plans, how they work is surprisingly different. In fact, they often function in opposite ways.

The Maximum

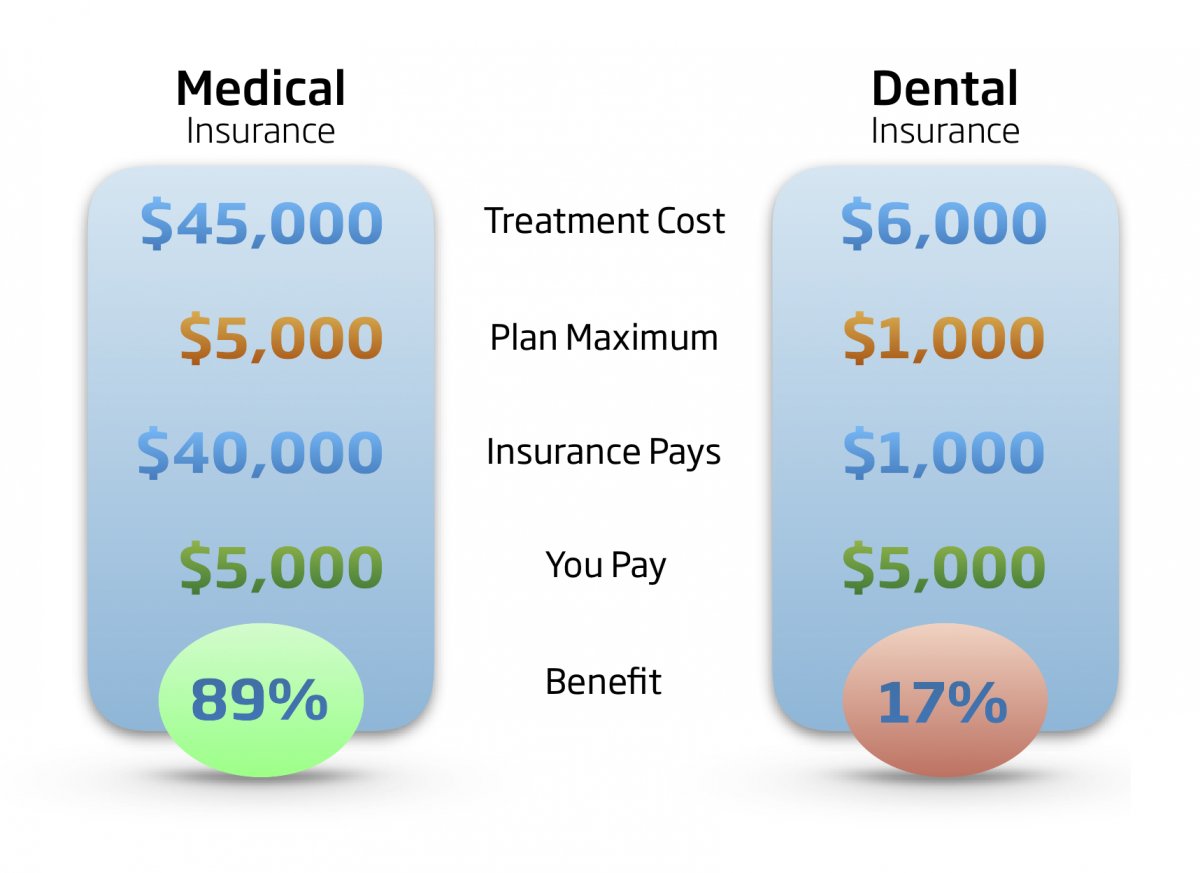

One familiar element of insurance is the "maximum." Medical insurance plans typically have an "out-of-pocket" maximum. It's a limit on how much you, the patient, would pay for a procedure, while insurance pays the remainder of the tab. Say, for example, a certain medical plan has a maximum of $5000 and a hospital procedure cost $45,000. With your plan, you would pay only your maximum ($5000), and the insurance would cover the rest ($40,000). That's a bit simplified, but it demonstrates the potential benefit of medical insurance.

For dental insurance, the maximum isn't the max you pay, it's the max they pay. Say your dental plan has a maximum of $1000 (which is typical for many plans). If your dental treatment cost was $6,000, the insurance pays $1000 while you pay $5,000 — a very different benefit ratio when compared to medical insurance.

Although these scenarios are hypothetical, they are not far-fetched. The dental example is actually a routine scenario.

Cost of Insurance

Analyzing the dental numbers a little deeper reveals yet a bigger problem. Your monthly cost for dental insurance may be about $60. That's over $700 per year. Some plans (especially individual plans) have a waiting period requiring you to pay premiums for a year before the insurance will even consider covering major procedures. This means you would have to pay the insurance almost $1500 in premiums (two years worth) to receive about $1000 in benefits (their annual maximum).

The scorecard for dental insurance isn't looking good so far. But what about employer-sponsored plans?

Group Plans vs Individual Plans

Group plans might be provided at no cost to you. Although nothing is truly free (remember TINSTAAFL from high school economics?), you might have no premiums to pay directly. If you are employed by a large company with benefits, then your Human Resources department has likely provided you a detailed comparison of your choices. As long as these group plans are administered by a quality carrier (Cigna, MetLife, EBA&M, or even Aetna, Guardian, and United Concordia), they are usually worth having.

Group plans typically have no waiting periods and have policies which are more harmonious to your well-being. This means group plans are more reasonable to work with, and they usually cover needed procedures without too much fuss.

Individual plans are more profit-oriented. Their policies aim to minimize payouts which often leads to unreasonable denial of claims. For this reason and more, I almost always advise my patients to drop individual dental plans immediately. There is usually no financial benefit to having an individual dental plan. In fact, there is usually financial harm — they simply must make a profit off you and only you. There is no "group" to spread out the risk or share the costs.

PPO vs HMO Plans

HMO plans are based on a more progressive philosophy. This actually doesn't seem too bad on paper, but as you might imagine, most dentists strongly disagree with the HMO concept. It goes contrary to the beliefs and motivations that dentists are trained for as healthcare providers. As such, HMO plans typically present unreasonable barriers to providing and obtaining quality dental care. In some communities, finding a dentist who accepts HMO plans can be difficult. And if you do find one, your experience there might not be what you expect, or deserve. My advice is to steer clear of HMO plans.

PPO plans tend to provide more freedom to patients and doctors. Therefore most dentists do accept and may even choose to participate in PPO networks. Group PPO plans from Delta, Cigna, and MetLife tend to be the best. EBA&M and Guardian is pretty good too. Aetna and United Concordia are not bad either. Most others... not so much.

Of course all carriers offer both good quality and poor quality plans. Generally, the bigger the employer, the higher the quality of the dental plan offered. For example, Apple or Disney offer their employees pretty great dental plans. But a small company with ten employees generally cannot afford the better plans. These small business insurance plans are often not worth having (financially). If you are trying to decide on a plan, a consultation with your dentist or potential dentist will be more helpful than information received by the insurance company. (They will always advertise great benefits, while your dentist will tell you the practical reality of how that plan operates.)

In-Network vs Out-of-Network

The "in-network" concept is about marketing and insurance company profits. For a dentist, being "in-network" provides more patient exposure which can be helpful for a young dental practice. The insurance company "sells" the dentist a higher number of patients in exchange for lower treatment fees. This is generally appropriate for high-volume offices and just adequate treatment quality.

As insurance consumers, we often hear that "you can save money by choosing an in-network dentist." The truth is that this claim is advertised by the insurance carrier. Their motivation is for dentists to participate in the network so reimbursement rates can be lower. Reality is a bit different. Most insurance companies will pay higher fees for out-of-network dentists. That's bad for the insurance company, but it's good for the patient. This means patients can enjoy a higher quality service and often pay less. For this reason we are out-of-network with all insurance plans. This helps patients financially by reducing costs while allowing uncompromised quality of care.

Disaster Preparedness

You may be thinking you should have dental insurance just in case the worst happens. After all, the whole point of insurance is "pay a little now just in case," right? Well this concept applies to many types of insurance. But does it apply to dental insurance? Let's look at some simple examples.

Life insurance: A $1,000,000 policy might cost about $1800 per year. The cost vs benefit ratio is huge.

Homeowners: about the same thing.

Car insurance: about $1200 per year can cover about $300,000 in damages.

Medical insurance: about $5000 per year can cover an unlimited amount in damages, potentially 5 or 6 digits.

Dental insurance: about $700 per year can cover about $1000 in damages.

See the difference? The potential benefit ratio of dental insurance is generally minuscule.

Although people are more likely to see a dentist regularly when they have insurance, it's actually a fallacy to think you "can't afford it because you have no insurance." I've heard this so many times and it makes me so sad to find that if my patient came to me 6 months prior with no insurance, it would have cost $200 to fill the tooth, but now with insurance, because he waited, the problem is going to cost $2000 to the patient, not counting the premiums paid. "An ounce of prevention is worth a pound of cure."

Effect on Society

Dental insurance can sometimes mistakenly lead to a shift of perceived responsibility. Some patients confess, "if my insurance doesn't pay for it, I won't do it." The illogic behind this is dangerous to health. Insurance companies don't sell "health." Doctors do. Your health is not the primary consideration behind insurance company decisions. Therefore if an insurance company denies coverage for a specific procedure, it doesn't mean the treatment isn't needed or beneficial. What is truly needed is between you and your doctor.

To demonstrate this effect, one must study a bit of history. The concept of dental insurance was born in the 1950's and approved for a pilot run in the 1960's in two states, California and Massachusetts. Tracking the effect on the states' populations might be surprising. The overall dental health of these two states deteriorated faster than any other state without dental insurance.

Often, dental treatment is more cost effective without dental insurance. In fact, most dentists will provide substantial discounts for patients without insurance. If you would like to know even more, please don't hesitate to contact us and ask.

Conclusion

Dental insurance is a double edged sword. Large group plans from large employers are great. Small group plans, HMO plans, or individual plans should be avoided.

Depending on insurance to make decisions for your healthcare leads to improper healthcare decisions.

Often, costs for dental treatment are lower without insurance.

I hope this has been helpful in making your choices for insurance and healthcare. Please see a biological dentist at least twice a year for optimal health and to keep healthcare costs at a minimum. That is actually the BEST insurance there is.

Categories: Insurance